Formula of Ratio Analysis | Grade 12| Account

Formula of Ratio Analysis

Grade 12 Account

Liquidity ratio

Current ratio

Debtors,

Bill / Notes/ Account receivable, Book debt, Inventory, Opening stock, Closing

stock, Cash and Cash equivalent, Prepaid expenses, marketable securities, Interest

accrued on investment, Stores and spare parts, Loose tools, Stock in trade,

Work in progress, Advance, and loan to subsidiaries.

Current liabilities are

Bills

/ Notes /Account payable, Sundry creditors, Income received in advance,

Unclaimed dividend, Bank overdraft, Premium on redemption of debenture,

Outstanding expenses, Fixed deposit, Short-term loan, Other unsecured loans

Quick / Liquid / Acid ratio

Where Quick assets are

Current assets – Current

liabilities

Solvency ratio

Debt-equity ratio

Long-term debt

Debenture

+ Loan and advance from bank + Bond + Other secure loans

Shareholder’s Fund /

Shareholder’s Equity

Share

capital + Share forfeiture + Calls in arrear + Share premium + Profit and loss

appropriation a/c + Capital reserve + General reserve + Debenture premium +

Capital redemption reserve + Sinking fund + Dividend equalization fund + other

reserve – (Preliminary expenses + Discount allow in the issue of share + Loss

incurred on issue of debenture)

Debt to total capital ratio

Capital Employed = Long term debt + Shareholders’ fund / equity

Or,

= Total assets (Excluding fictitious

assets) – Current liabilities

Or,

= Fixed

assets + Current assets – Current liabilities

Or,

= Fixed

assets + Working capital

Note

Working

capital = Current Assets – Current Liabilities

Turnover Ratio

Inventory Turnover Ratio

Note:

Gross profit = Sales – Cost of

Goods sold

Cost of Goods sold = Sales –

Gross profit

Sales = Cost of Goods sold +

Gross profit

And,

Average Inventory = (Opening stock + Closing stock) / 2

Note:

In the case of inventory turnover ratio: if opening inventory and closing inventory

both are calculated, we use (Cost of goods sold / Average inventory) and if

inventory is, only we should use (Sales / Closing Inventory)

Debtors Turnover ratio

Note:

If

credit sales and average debtors both can be calculated or given, we should use

(Net credit sales / Average debtors) and if credit sales and average debtors

anyone cannot be calculated what we should use (Total sales/closing debtors)

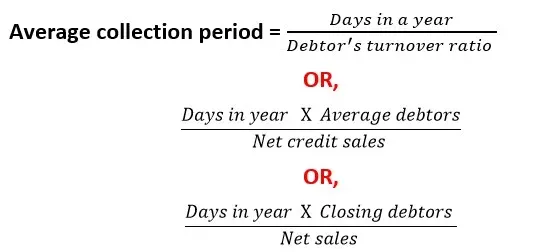

Average collection period

Fixed assets Turnover

Note

Net sales = Sales – Return

Net fixed assets = Fixed assets – Depreciation

Total assets turnover ratio

Capital employed turnover ratio

Profitability Ratio

Gross profit margin

Net profit margin

Return on assets

Return on shareholders’ equity

Return on equity shareholders’ fund

Return on capital employed

. Earnings per share

Dividend per share